According to a new report published in mid-March of Pyn Elite Fund, this fund assess Vietnam's stock market is still a lot of geographical growth when macroeconomic indicators, valuations are at attractive levels compared to the market in the area.

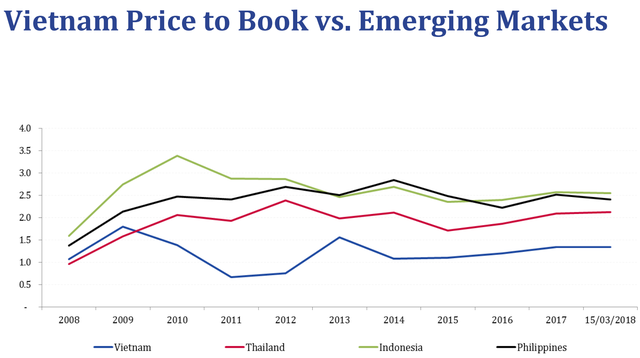

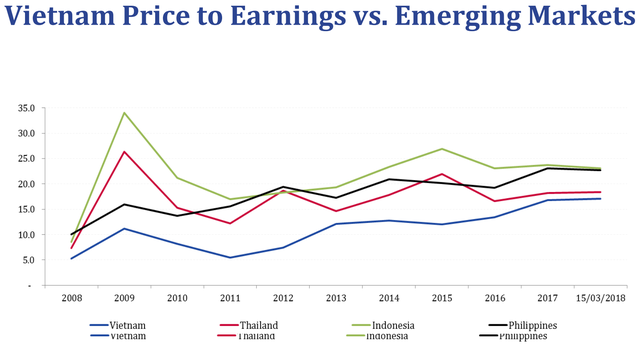

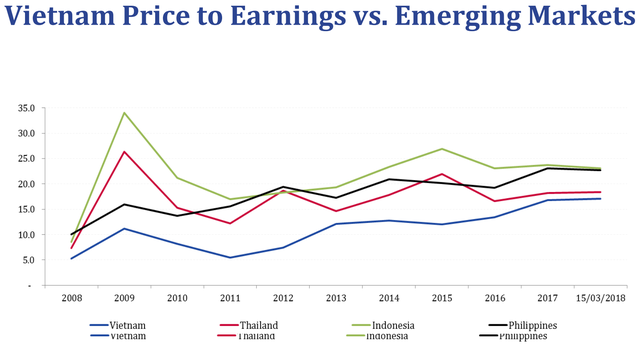

Specifically, Pyn Elite Fund forecasts Vietnam's GDP in 2018 will reach about 235 billion US dollars, an increase of 7% compared to last year. Meanwhile, Vietnam's stock market is currently undervalued compared to Thailand, Indonesia, the Philippines when the P / B as calculated by the Fund only Pyn Elite is 1.4 and P / E near 17.

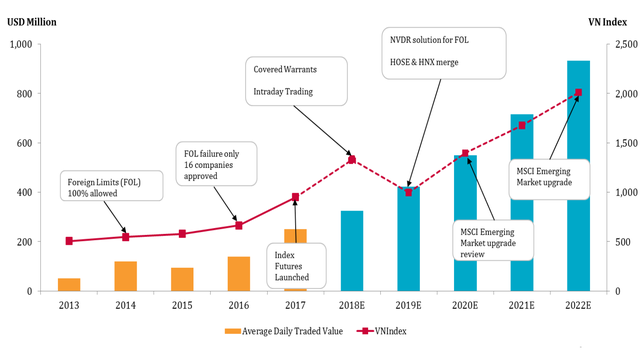

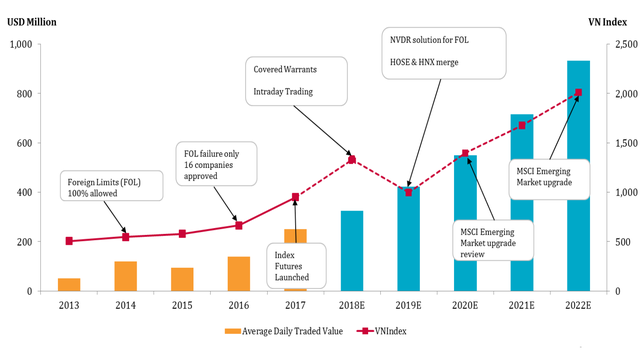

Pyn Elite Fund said in 2018, VN-Index will reach 1,400 points and the Vietnam stock market will launch new products such as "Chứng quyền đảm bảo" (Covered Warrants), "Giao dịch trong ngày" (Intraday Trading).

However, to 2019, Pyn Elite Fund said that Vietnam's stock market will see a little bit more difficult and VN-Index may be adjusted in the region of 1,000 points, before climbing milestone of 2,000 points in 2022 when MSCI officially recognized as "Thị trường mới nổi" (emerging market).

As a Finland investment fund, now Pyn Elite Fund has a total asset of € 444 million ($ 550 million) and is investing entirely in Vietnam. Currently, "Thế giới di động" (MWG) is the largest investment, accounting for 13% of the portfolio.

By the end of December 2017, the fund had spent nearly $ 40 million to own 4.99% stake in TPBank, making it the fourth largest fund after MWG, HBC and CII.

In present, Pyn Elite Fund's net asset value per NAV (NAV) is $ 324.09, up 2% from the beginning of the year. Previously, in 2017, the fund's NAV also increased to 21%. Pyn Elite Fund's 10-year average profit reached nearly 17 percent, ranking 8

th among investment funds rated by Morningstar.

From the beginning of the year to now, PAN is the biggest contributor to Pyn Elite Fund with EUR 9.91 million, followed by VND, KDH, HDB and NLG. In contrast, the MWG is the worst investment and makes the fund loses more than EUR 11 million.

Minh Anh

Trí thức trẻ

Cafef.vn