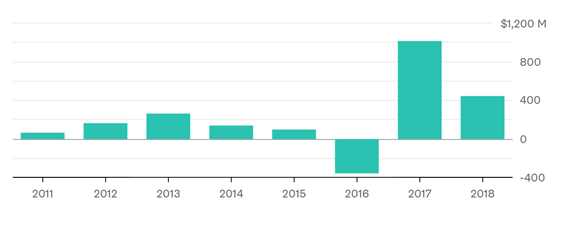

Foreigners have purchased more than $440 million of Vietnamese shares this year, after record inflows in 2017

There are many things to like about Vietnam. In the first quarter, its economy expanded by 7.4 percent, the fastest pace in a decade. Meanwhile, U.S. President Donald Trump is too busy picking tariff fights with China to bother with the frontier nation, whose government is targeting double-digit export growth this year.

Foreigners are also keen to own meaningful stakes in Vietnam's key beverage, oil and financial firms. Laden with public debt, Hanoi is hungry for extra cash. Authorities gained about $4.8 billion last year via a stake sale in Saigon Beer Alcohol Beverage Corp.; this year the government plans to sell 6.5 times more shares than it offered in 2017, Deputy Prime Minister Vuong Dinh Hue said in an interview with Bloomberg Television in January.

Speculators are rife, and some are trying to get ahead of passive funds that follow the MSCI country indexes. Vietnam now boasts better liquidity than the Philippines, which is classified as an emerging market. Traders say it should be poised for inclusion in the MSCI Emerging Markets Index, which is tracked by funds with more than $1.6 trillion in assets under management.

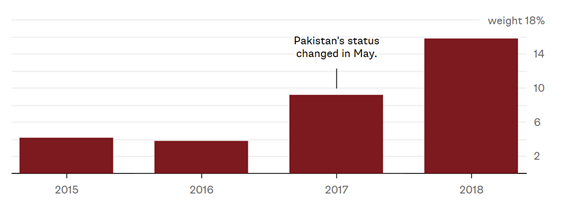

Even if that doesn't happen, Vietnam may receive more international inflows if some of its peers get a boost. Argentina is already on MSCI Inc.'s watch list for a potential reclassification from frontier to emerging market, while rival index compiler FTSE Russell classified Kuwait as an emerging market last year. Vietnam is currently the third-largest country in the MSCI Frontier Markets Index.

Vietnam is now the third-largest country in the MSCI Frontier Markets Index, after Argentina and Kuwait. Pakistan made it to emerging-market status last year

Source: Bloomberg

Note: Data refer to the last day of April each year. 2018 use latest data.

But for investors, this can be a dangerous game. The 15 stocks on the MSCI Vietnam Index, which should benefit the most should this bet pay off, are very pricey. The gauge trades at 30.5 times 12-month trailing earnings; the broader Vietnam Stock Index is at a more reasonable 21 times.

The MSCI Vietnam Index, which has only 15 stocks, more than doubled in just two years and is now trading at a frothy 30.5 times earnings

Vietnam's stock market is also becoming less insulated from macroeconomic events, reducing the appeal of portfolio diversification for global fund managers. Earlier this year, the correlation of weekly returns between Vietnamese and U.S. stocks shot up to 67 percent, a sharp reversal from a relationship that at times has been negative. In other words, if the U.S. catches a bad cold, Vietnam starts sneezing.

Vietnam was largely immune to the ups and downs in the U.S. stock market. Not anymore

Source: Bloomberg

Note: Data look at weekly returns.

Pakistan provides a timely warning. For at least a year-and-a-half before its May 2017 upgrade by MSCI to emerging-markets status, speculators piled in, only to have the Karachi Stock Exchange 100 Index tumble ahead of the official inclusion date.

To be sure, Vietnam is in much better shape than Pakistan, as I have arguedbefore. But at such elevated levels, it's easy to find reasons to sell. A GDP miss, an inflation uptick, and Ho Chi Minh City could turn cold real quick.

By

Shull Ren

Bloomberg.com

Reader Comments